Cobalt Supply Chain Analysis Links Electric Vehicle Manufacturing and Deployment

Cobalt is mined, processed, and refined into battery-grade precursors that manufacturers then produce into cathode sheets for lithium-ion battery cells used in electric vehicles. Photo courtesy of iStock

May 18, 2021—Cobalt is considered a critical raw material. It’s used in many sectors from electronics to health care and is an essential component of most lithium-ion batteries used for electric vehicles (EVs). From 2014 to 2016, the amount of cobalt used in EVs surged from 1.4% to 5% of the world’s total cobalt mine production. By 2020, 20% of cobalt demand will be driven by electric vehicles, according to Global Energy Metals Corp.

The increasing demand for cobalt has raised questions about the larger EV manufacturing supply chain—how will increased EV deployment impact mineral production and vice versa? However, the link between raw materials and manufacturing has traditionally been difficult to study due to lack of upstream data for raw materials and challenges to tracking materials through many links of the manufacturing supply chain.

As part of the recent Benchmarks of Global Clean Energy Manufacturing report, analysts at the Joint Institute for Strategic Energy Analysis (JISEA) Clean Energy Manufacturing Analysis Center (CEMAC) applied the benchmark methodology to raw materials for the first time. Using existing data, they assessed the impacts of the cobalt supply chain on clean energy manufacturing from 2014 to 2016.

Resulting insights, published on pages 67 to 72 of the Benchmark report, show the value added to economies from mining, processing, and refining cobalt for clean energy manufacturing, along with potential supply chain risks and opportunities.

What Countries Supplied Cobalt?

Cobalt is usually mined as a byproduct of either copper (67%) or nickel (32%)—just 1% of cobalt mining production is dedicated to cobalt extraction. Most cobalt deposits are in the Central African Copperbelt, which includes the Democratic Republic of the Congo (DRC), Central African Republic, and Zambia.

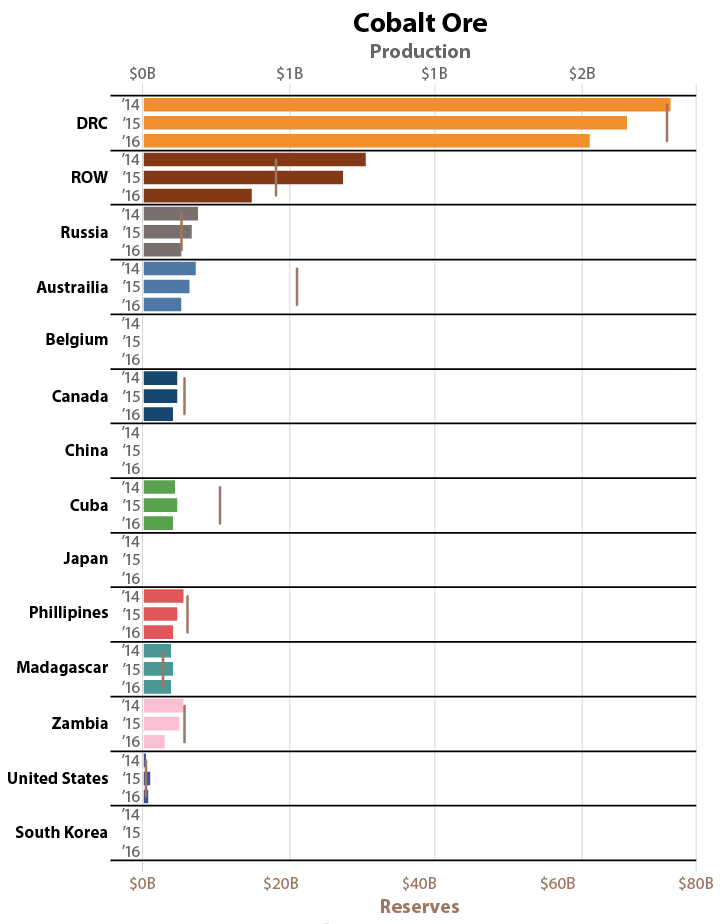

The DRC led all suppliers from 2014 to 2016 with a global production share of 53%. Overall global cobalt production decreased by 7% from 119,000 metric tons in 2014 to 111,000 metric tons in 2016, partly due to declining prices of copper and nickel.

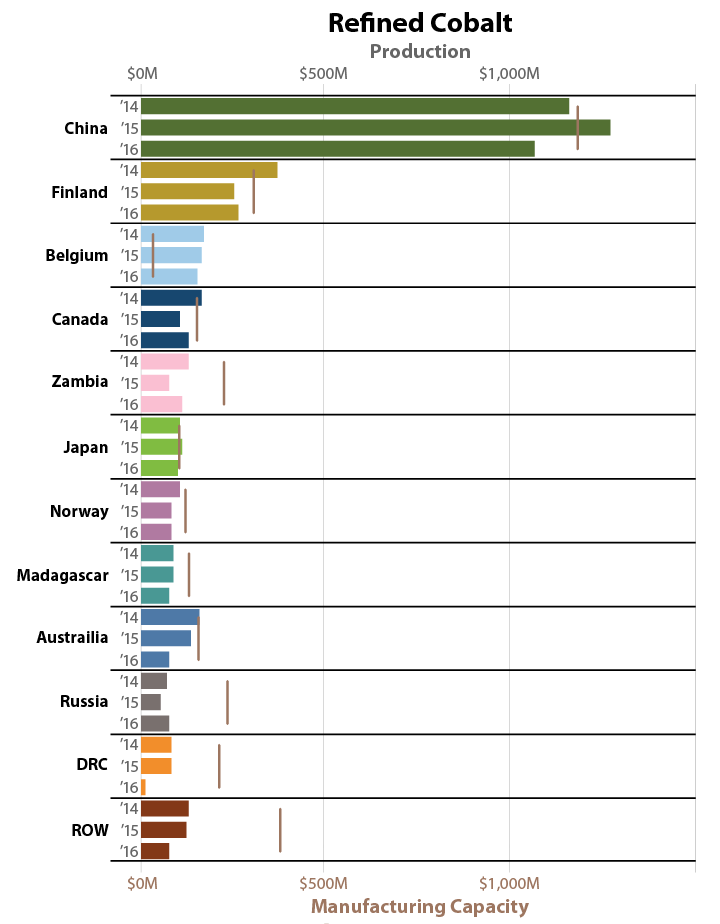

Most of the DRC's mines are owned by Chinese companies, which support its large domestic cobalt refining capacity and accounted for about 47% of the world's refined cobalt production from 2014 to 2016. Excess global manufacturing capacity in 2016 suggest there is capacity available to meet growing future demand.

Cobalt ore production (colored bars) and reserves (brown lines) for each of the benchmarked economies across the 3 years studied from 2014 to 2016. Dominican Republic of Congo had the highest production and largest supply of natural reserves during the time period. All data are in US$ (2014).

Refined cobalt production (colored bars) and manufacturing capacity (brown lines) for each of the benchmarked economies across the 3 years studied from 2014 to 2016. China had the highest production and manufacturing capacity during the time period. All data are in US$ (2014).

Which Economies Traded Cobalt?

The DRC was the lead exporter of cobalt materials (ore, concentrates, other intermediates, and refined products) from 2014 to 2016, totaling $4.5 billion worth of materials. China was the leading importer, totaling $3 billion of materials.

Most economies experienced a slight decrease in cobalt exports and imports with the economic slowdown in emerging markets and associated declines in metal prices. The DRC experienced the biggest decline in exports with $1.8 billion in 2015 and $1.3 billion in 2016.

How Much Value Did Cobalt Add to Economies?

China, as the primary cobalt refiner, accrued the greatest total value over the period, totaling $870 million in 2016. The total value added in the United States declined from $40.2 million in 2014 to $32.9 million in 2016 due to decreased production.

Of the economies that are major benchmarked manufacturers of clean energy technologies, Canada and the United States were the only two that accrued direct value from cobalt mining during the period; China, Japan, and Canada were the only economies that accrued direct value from domestic cobalt refining.

What Is the State of Lithium-Ion Battery Recycling?

At the end of their useful life, recycling lithium-ion batteries could help establish a circular economy for cobalt and other materials.

China currently leads the world in recycling lithium-ion batteries. It established end-of-life policies and regulations for EVs and rules for automakers to collect and recycle the batteries. South Korea and the European Union also have policies to manage retiring EVs. Still, lack of feasible collection mechanisms, low collection volumes, and insufficient information on long-term costs and benefits have prevented investment in recycling for many countries, including the United States.

Knowledge of the supply chains of raw materials used in the manufacturing of light-duty lithium-ion batteries is important for making decisions on material sourcing, processing and manufacturing, materials substitutions, and technology research. JISEA/CEMAC plans to continue exploring these important upstream links in the clean energy economy.

Read the Benchmarks of Global Clean Energy Manufacturing for more clean energy manufacturing insights.

Get the high-level findings in our JISEA Research Highlight.

Back to JISEA News >