News and Blog

The Joint Institute for Strategic Energy Analysis (JISEA) increases the impact of its analysis by staying engaged in and helping to shape the global energy dialogue. News and blogs about JISEA, JISEA leadership, JISEA partners, and JISEA programs are highlighted below.

Want more? Sign up for our email news or follow us on Twitter.

Hydropower Turbine Market and Trade Values: A closer look at small hydro turbines in the U.S.

December 14, 2016 — Hydropower has been a long-term stable power generation source in the U.S. for decades. In Oak Ridge National Laboratory's (ORNL's) 2014 Hydropower Market Report, researchers found that hydropower represented approximately 7% of the U.S. generation capacity in 2014 and accounted for 6.3% of U.S. electricity generation in that same year. As indicated in the U.S. Department of Energy (DOE) 2016 Hydropower Vision Report, there is a significant electricity generation potential from powering domestic, non-power hydro dams, which would utilize smaller turbines.

Recognizing this, a potential growth in the U.S. and international market demand for small hydro turbines could offer greater opportunities for local and more energy-efficient manufacturing practices, both within the U.S. and for export.

With support from the DOE Office of Energy Efficiency and Renewable Energy's Water Power Technologies Office, CEMAC is working collaboratively with the National Renewable Energy Laboratory (NREL) and ORNL to analyze the global hydropower supply chain—and identify opportunities for manufacturing improvements on small hydropower components.

The U.S. International Trade Commission (USITC) breaks up the U.S. hydropower turbine and water wheels market by four Harmonized Tariff Schedule (HTS) trade codes, which represent three classes of hydraulic turbines:

- Turbines with capacity ≤1 Megawatt (MW) (HTS code 8410.11)

- Turbines with capacity >1 MW, but ≤10 MW (HTS code 8410.12)

- Turbines with capacity >10 MW (HTS code 8410.13).

The fourth code is for the "parts, including regulators, of hydraulic turbines and water wheels" (HTS code 8410.90)i needed for all three turbine size classifications. Regulators are mechanical devices that control the flow and pressure of water, such as valves, pumps, and gates. There is also a category identified by the USITC that includes hydraulic turbines as turbine-generator sets (HTS code 8502.39). Turbines imported with a generator are classified as generating sets and are included in 8502.39.ii

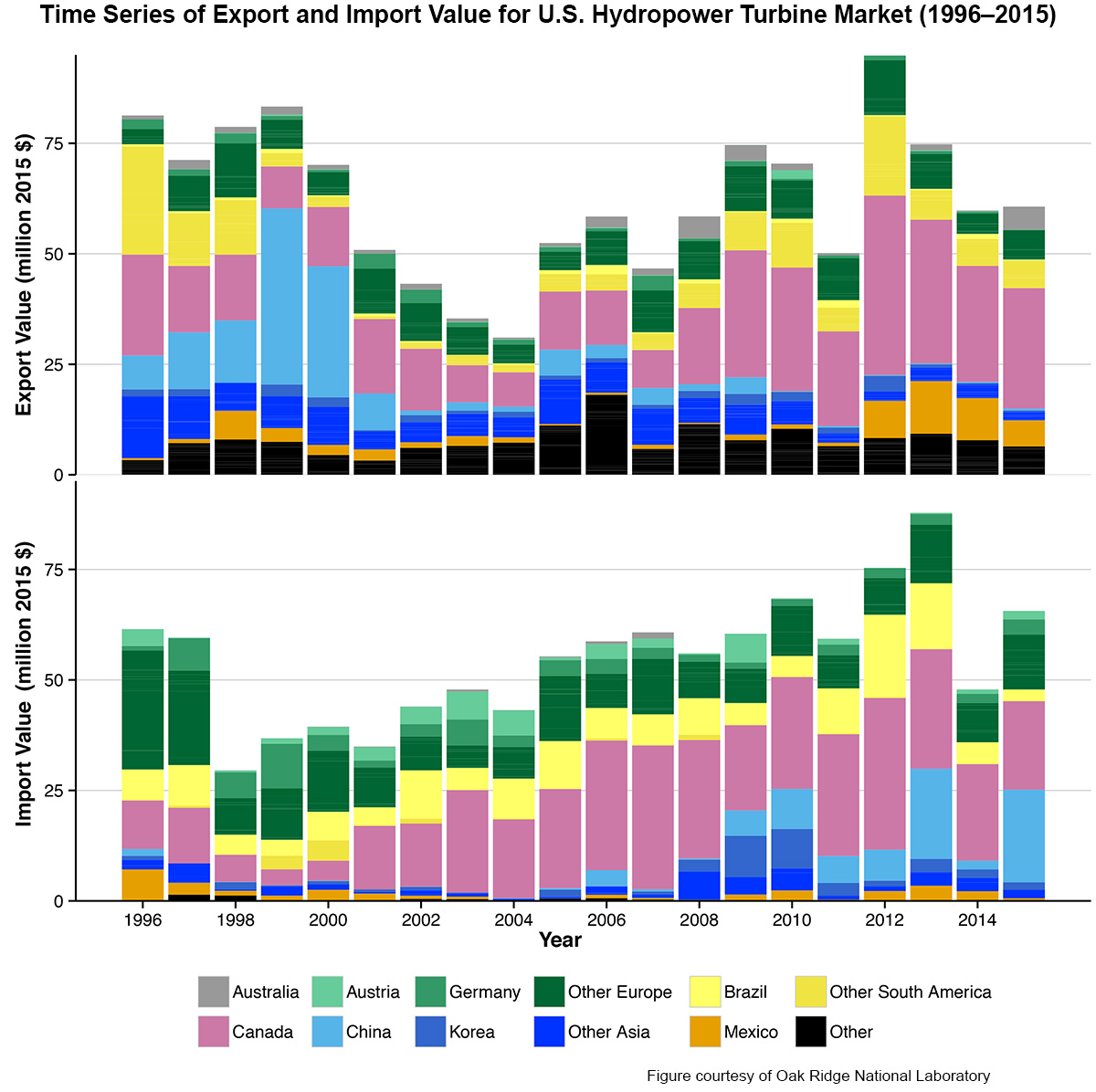

Below, ORNL's time series chart displays the export and import value in millions of dollars by country and/or region. The chart represents the entire U.S. hydropower turbine export market from 1996 to 2015, with the exception of turbine generator sets for which a hydropower-specific HTS code is currently not available. (For additional details, see ORNL's 2014 market report and 2016 update).

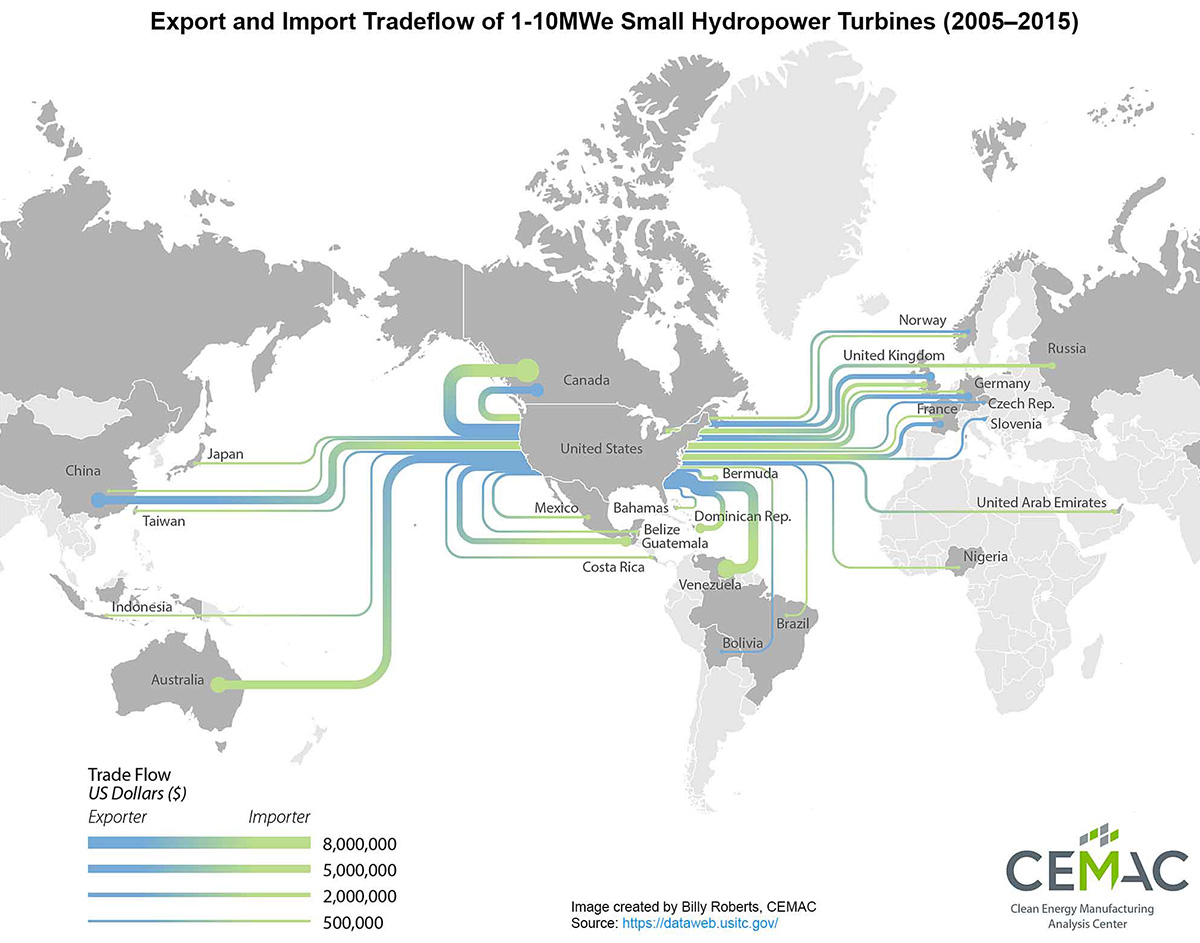

With consideration of the time series chart, CEMAC extracted data for the smaller 1-10 MW hydropower turbine range to gain a better understanding of the manufacturing opportunities and added value along the small hydropower supply chain. The below tradeflow map illustrates how the U.S. is interacting with other counties for small hydro turbines. Using consolidated data from 2005-2015, the blue lines represent export flow from the U.S., green lines represent imports to the U.S., and the thickness of the line indicates the value of the trade in dollars as either an export or import.iii

The map shows that from 2005-2015, the 1-10 MW small hydro turbine market was approximately $35M for U.S. domestic exports and $16M for U.S. general imports. The U.S. exported small hydro turbines to 45 countries, including Canada, Venezuela, and Australia. The U.S. imported small hydro turbines from countries such as China, Germany, UK and Canada, all of which have 1-10 MW turbine manufacturing facilities.

Looking at the same time period and focusing on the U.S. export value of the "parts including regulators" for HTS code 8410.90, we can see that the export value for the U.S. is approximately $393M.i This clearly highlights that the exports of upstream parts and regulators for the overall hydropower turbine market is over 10 times in value of small turbines. A key insight from the ORNL 2014 market report is that the significance of the parts market is likely due to the rehabilitation and modernization happening within the U.S. hydropower fleet. According to the report, approximately $3.6 billion was spent to repair, replace, and refurbish U.S. hydropower facilities. However, this does include the replacement of parts and upgrades, all the way up to rebuilding dams.

Moving forward, CEMAC plans to explore how the small hydropower market might be affected by factors such as variations in global labor rates and differences in component costs. Further investigation will evaluate the decisions on choosing manufacturing locations for small hydropower turbines. Finally, analysis teams at NREL and ORNL are developing Design for Manufacturing and Assembly (DFMA) models to provide insights into the manufacturing processes and potential manufacturing costs of specific components of the system.

i "Interactive Tariff and Trade DataWeb," United States International Trade Commission (USITC), data extracted for 2005 to 2016 and segregated for the "Parts, including regulators, of hydraulic turbines and water wheels" trade code HTS 8410.90. Accessed September 2016, https://dataweb.usitc.gov/.

ii Turbines imported with a generator are classified as generating sets and are included in 8502.39. However, the current breakout of code 8502.39 does not distinguish which generating sets are used for hydroelectric production versus other electricity production technologies. For instance, gas turbines generating sets are also included in 8502.39. See page 67 from ORNL's 2014 Hydropower Market Report for further details.

iii The data shown does not represent each country's total export or import data for the 1-10 MW turbines, and only countries with exports greater than $200,000 and imports greater $150,000 are represented.

Back to JISEA News >